Virtual Reality (VR) refers to a computer-generated, immersive reality. The applications of VR enable new forms of collaboration in which people can interact and work together no matter where they are. While these virtual spaces and worlds are already being put to use in some industries (e.g. in companies, education, entertainment), they hold the potential to support economy and society in all aspects of life.

VR is often associated with the terms ‚Metaverse‘ and ‚Web3‘. The Metaverse refers to an augmented virtual reality in which the digital and physical worlds merge. In this immersive and interactive environment, users can act as avatars and communicate with each other in real time. Web3, also known as the next, decentralized development stage of the web, among other things, is based on distributed ledger technology (DLT) and enables the tokenization of real and virtual assets. It enables the creation and interaction with digital content, services and assets in a decentralized and transparent way.

oenpay considers these technologies a vital asset in driving innovation in payments. Hence, the innovation initiative will investigate and develop further new solutions in the virtual space in the scope of various projects.

In the scope of the hackathon ‚Virtual Design Challenge‘, oenpay is searching for innovative design concepts of a virtual space. In doing so, the innovation initiative aims to seize the potential of VR for itself and partner companies and to make new applications a virtual experience.

oenpay is particularly interested in researching new payment solutions that can be used to process digital transactions in virtual space securely and easily. A virtual space is intended to support this mission by providing a modular structure and versatile functions. The design should be futuristic, correspond to the brand image of oenpay and visualize the topic ‚payments‘ in an innovative way. The concept must have a modular structure so that the virtual space can be flexibly expanded.

The best idea will be awarded prize money of EUR 2,000. In addition, the most innovative ideas will then be analyzed, elaborated and maybe even implemented together with oenpay.

In the scope of ‘oenpay’s Hitchhikers guide to the Metaverse’, we will share with you our insights and learnings which we have gathered on our journey to the virtual world. We invite you to join us on this journey.

The term “metaverse” was first used in Neal Stephenson’s novel ‘Snow Crash’, published in 1992, and became better known through ‘Ready Player One’ by Ernest Cline. It refers to a digital universe of interconnected virtual worlds in which people can interact in a variety of ways.

To date, there is not a single, all-encompassing metaverse, but many fragmented versions, often driven by different technology companies.

Current technologies such as Virtual Reality (VR) and Augmented Reality (AR) have built the foundation; however, the concept is still in its infancy. While it promises great potential in areas like education and the arts, there are also privacy and security concerns.

The Metaverse is driven by a variety of technological developments and concepts. Aside from the XR technologies, here are some other key technologies and concepts that will likely be critical to the development and implementation of the Metaverse:

XR combines real and virtual elements with human-machine-interaction whereas AR includes virtual information in the real world, such as shown in Pokémon GO. VR fully emerges it users in a digital environment and is mostly used for entertainment purposes, but is also applicable to other industries, such as medicine.

To create realistic virtual worlds, one requires technologies to scan real-life objects and environments and transfer them into digital models. This allows for the creation of hyper-realistic virtual worlds.

To ensure a fully immersive experience, users not only need to see and hear, but be able to feel things around them. Haptic technologies, such as VR gloves or suits offer physical feedback which allows users to feel connected to their environment.

These technologies enable secure and transparent transactions in the metaverse. Crypto tokens could serve as a monetary unit for the purchase of digital goods and services, in addition, blockchain technology can be used to securely store property, identity and other data.

AI systems could be used in the metaverse to control NPCs (non-player characters), provide personalised experiences, or analyse user interactions to dynamically adjust environments.

As the metaverse requires huge amounts of data and computation, cloud and edge computing technologies will be necessary to perform data processing efficiently and close to the end user.

We anticipate that there will be many different metaverse platforms in the future. Therefore, the ability to share data, avatars, objects and experiences between them is crucial. This requires standards and protocols that enable the smooth exchange of data.

Overall, the Metaverse will require many technologies to interact with each other to create a seamless and immersive experience for the user. It is a multidisciplinary endeavour where software, hardware and design are closely intertwined.

But where exactly is the Metaverse, how do you get there and what do you need? If you want to take a trip to the metaverse, you have to make some preparations. This ranges from choosing and purchasing the appropriate technical equipment (e.g., VR goggles), selecting a suitable virtual world and its applications to designing your own virtual environments.

But everything step by step – follow us step by step on the journey into the metaverse. Stay tuned!

Greentoken (project name) is a special-purpose reward token. Special-purpose tokens provide an incentive for individuals to contribute to a collective goal by changing their behavior, e. g. reducing negative externalities on a collective good. At present, the Greentoken concept focuses on reducing carbon emissions from shopping as an example, but it can also be used for other sustainable causes.

The concept addresses four dimensions: Greentoken creates awareness of own behavior, provides an incentive for changing it, supports sustainable projects and encourages others to get involved, too.

At the heart of the concept is a smartphone app that determines, and allows users to clearly see, the carbon footprint of their shopping. The system is intended to work with several means of payments (debit or credit card, e-wallet etc.) for shopping in-store and online. This allows users to get to grips with the carbon footprint of their shopping habits. People need detailed information about the carbon footprint of what they buy so they can make informed decisions.

Users who change their behavior for the better are rewarded with Greentokens. Specifically, they are rewarded for buying lower emissions products to reduce the carbon footprint of their day-to-day shopping. They can save the Greentokens collected this way in a digital wallet in the smartphone app.

Users can then donate these Greentokens to sustainable projects. Eligible projects have undergone a thorough vetting process and are certified to the highest standards. The users themselves decide which project they wish to donate to (focus on regional projects).

For their efforts and donations, users are awarded with digital badges (NFTs). By displaying these badges on social media, they invite others to join the good cause, too.

Token systems are based on the blockchain technology. Put simply, blockchain is a special type of distributed database in which several independent users and network node operators jointly manage transactions in a tamper-proof manner.

Tokens are an extension of blockchain technology and form the basis for token-based applications. They can be created on a blockchain, which facilitates the development of token economy ecosystems – networks of relations in communities that pursue a common goal. Tokens can be conceptualized as containers of rights: They represent a right or authorization that the owner can exchange or use within a system. As tokens can be transferred, exchanged and programmed according to certain rules, they can be designed to suit different purposes.

In some respects, token economy ecosystems are fundamentally superior to traditional models.

In the next project phase, the Greentoken system will have to tackle two main challenges: correctly establishing the carbon footprint of new shopping habits and ensuring sustainable financing of the Greentoken system. Approaches to how to solve both challenges are already available and will be elaborated further during prototyping in cooperation with corporate partners.

The Austrian Blockchain Center (ABC) is a COMET competence center headquartered in Vienna. Its mission is to be Austria’s prime science hub for blockchain and related technologies. Blockchain technology facilitates the secure cooperation of different participants. It lends itself to a broad range of applications, from digital currencies to industry, finance, energy and logistics solutions to public services.

ABC is an interdisciplinary and application-oriented research institution dedicated to all aspects of blockchain research with a special focus on technological, commercial and legal issues. As one of Austria’s COMETs (Competence Centers for Excellent Technologies), ABC receives funding from the Austrian Federal Ministry for Climate Action, Environment, Energy, Mobility, Innovation and Technology, the Austrian Federal Ministry of Labour and Economy and the provinces of Vienna, Lower Austria and Vorarlberg. The COMET program is managed by the Austrian Research Promotion Agency (FFG).

The jury selected Karen Schwien as the winner of the “e-IDentify yourself” OeNPAY Electronic Identity Challenge. Her idea of a secure, modular metaverse identity stood out from the other 156 entries and was honored with EUR 3,000 in prize money. In this interview, the winner talks about her motives and presents her idea.

The use case would provide users with a secure electronic identity in the metaverse or web3, but without them having to divulge too much personal information. Specifically, Karen proposes a modular eID solution: While it is a fully-fledged subjective digital identity, its scope is tailored to different contexts, so it does not necessarily point to a real person. This would go a long way towards enhancing individual user security and privacy in web3.

I think digital identities are a key future topic for two main reasons: They provide the foundation for secure and fair digital transactions, and they allow people to experiment in the digital realm and create different identities for different contexts.

I am fascinated by digital innovation, and the metaverse has been all the buzz since Mark Zuckerberg’s presentation. So I have been paying increasing attention to the metaverse and web3. This field of application is especially exciting for eID solutions, as it opens up many new opportunities. For instance, protecting your online identity is essential when handling crypto assets, which may continue to play a significant role in web3. In my academic work, I focus on subjective identities in the digital sphere. Ensuring security is one aspect, experimenting and playing around is another. I have been very much inspired by the book Coming of Age in Second Life, which describes what matters to people in 3D worlds, how they reinvent themselves and how analog and digital identities influence each other.

I am fascinated by digital innovation and communicate about it with other people on different networks. I have been able to pursue this fascination in my professional life, too, first as an IT consultant and now in a project on platform-based online work. Digital identity has come up as an issue time and again, for instance in connection with cybercrime and hate speech on social media, privacy, efforts to simplify transactions, identity verification and the creation of new identities, e.g. in gaming.

The metaverse opens up an enormous space for new ideas. Co-creating the future of this digital world is especially fascinating to me. On the one hand, it offers advantages in that it facilitates online communication that encompasses body language or in that it provides new venues to meet, communicate and work together for people who never would have met otherwise, and other opportunities that the web 2.0 and the analog world just do not offer. On the other hand, this world can also give rise to negative effects: crime and areas of legal vacuum, high energy consumption and the associated environmental problems. Right now, we cannot tell whether the advantages will outweigh the disadvantages.

I work as a research associate for the Crowdwork project and at the professorship for vocational and occupational education at Helmut Schmidt University. After completing my studies in business administration and business psychology, I worked as a change management consultant in the IT sector.

All submitted ideas for the “e-IDentifizere dich!” – OeNPAY Electronic Identity Challenge can be found here.

eID technology offers numerous benefits for individuals and businesses alike. Taking full advantage of them requires a national eID infrastructure that meets cross-industry interoperability standards. The goal is an eID solution that serves as an interface to both private sector services and e-government services. OeNPAY aims to lay the foundation for such a comprehensive eID infrastructure in Austria in cooperation with all stakeholders.

OeNPAY ran the “e-IDentify yourself” OeNPAY Electronic Identity Challenge for three months to crowdsource ideas for brilliant, new eID applications that transcend the range of existing solutions and can be used in all walks of life. The idea contest aims to contribute to developing a comprehensive, interoperable eID infrastructure and to promote digitization in Austria and Europe in cooperation with all stakeholders.

“OeNPAY serves as a catalyst for innovation and bridges the gap between private and public market participants. Our goal is to promote a common, cross-industry solution and get people engaged in the process. We received a large number of contest submissions that highlight the broad range of potential eID applications in all walks of life. Implementing these applications is the next step to unlocking their potential at the national and international level.”

Franz Deim, Managing Director, OeNPAY Financial Innovation HUB GmbH

The winning entry, a secure, modular metaverse identity, was selected by a distinguished jury of experts from the innovation community, and the winner was awarded EUR 3,000 in prize money. The idea is to provide users with a secure electronic identity in the digital sphere, but without them having to divulge too much personal information.

“The metaverse (web 3.0) offers countless, virtually untapped innovation opportunities across different sectors. The winning idea of our contest advocates for developing new, secure solutions that prevent attacks on the user’s financial assets and identity data in cyberspace.”

Bernhard Krick, Managing Director, OeNPAY Financial Innovation HUB GmbH

„We found the idea especially inspiring – it was the most forward-looking of all entries. The metaverse is an emerging megatrend that has the potential to fundamentally change the way we live and work. It also has the potential to reshape payments from the ground up. This is why we found the idea so compelling.”

Joint jury statement

“We have seen how efficient cooperation of private and public sector providers helps spark the development of sound eID solutions. We of OeNPAY see ourselves as a catalyst of innovation, and we aim to bridge the gap between private and public market participants. Our goal is to promote a common, cross-industry solution and get people engaged in the process.”

Franz Deim, Managing Director, OeNPAY Financial Innovation HUB GmbH

“In our society, commercial activities, daily tasks and social connections are increasingly based on digital data. No matter if we are shopping, banking, driving a car, taking a vacation, working, doing leisure activities, making a phone call or spending time on social media: All these activities involve the processing of our personal data. Protecting the personal reference, our electronic identities, the data themselves and how they are processed is therefore becoming increasingly important.”

Kurt Einzinger, Data Protection Officer, Member at Austrian Data Protection Council

“Today, consumers manage 29 user profiles on average, which means they have to memorize several different login data. That is not just annoying – given the large number of profiles, users can easily lose track of who has what personal data. We need eID solutions that give people full control over their data at the highest security level, that can be used with applications in all areas of life. A case in point is our ich.app. This is why we are very much looking forward to learning about exciting new ideas put forward by users and market participants and exploring promising cooperation opportunities. The success of an eID solution in Austria and in Europe will hinge on its interoperability and range of potential applications.”

Harald Flatscher, Geschäftsführer, PSA Payment Services Austria

“Improve society with technology”

Andreas Freitag, Consultant für Blockchain, DLT & Self Sovereign Identity, trusinity

“Digital identities are an integral feature of our digitized working and living environments. They stand for convenience, efficiency and time and cost savings. Too many online applications still rely on low-security authentication methods, such as a user name and password. Secure digital identities are essential to unlocking the potential of digitization.”

Robert Jeller, Abt. Innovation und Digitalisierung, Wirtschaftskammer Österreich (WKÖ); Vorsitzender des Beirats A-Trust

“Digitization is happening at a fast pace in all spheres of life. Digital processes are becoming increasingly important for individuals, businesses and public authorities. Protecting one’s own digital identity is especially relevant in online transactions. We are on the lookout for fascinating eID applications that make life easier, more efficient and more secure without compromising user privacy.”

Bernhard Krick, Managing Director, OeNPAY Financial Innovation HUB GmbH

“Trust is essential to online transactions. Digital identities allow you to know who you are communicating with. Today, we are still exploring the range of possible applications. As a member of the jury for the OeNPAY Electronic Identity Challenge, I look forward to the presentation of innovative ideas on how digital identities can make the online world more secure and add variety, while at the same time respecting people’s right to privacy.”

Herbert Leitold, Director-General, Secure Information Technology Center Austria A-SIT

“A unique identity allows extending the rule of law to the Internet in an effective manner.”

Hartmut Müller, CEO, Notartreuhandbank AG

“The OeNB advocates for more competition, transparency and European autonomy with respect to payment systems. An important component of this endeavor is the digitization of identities. I look forward to learning about innovative ideas and approaches that will take us a step closer to this goal and to exploring cooperation opportunities between market participants and public institutions.”

Petia Niederländer, Director Payments, Risk Monitoring and Financial Literacy Department, Oesterreichische Nationalbank

“My wish is a context-sensitive eID that just provides access to the data required in a given situation.”

Katja Schechtner, Senior Urban Scientist and Advisor for Innovation & Technology, Visiting Professor University of Applied Arts Vienna; Research Affiliate MIT

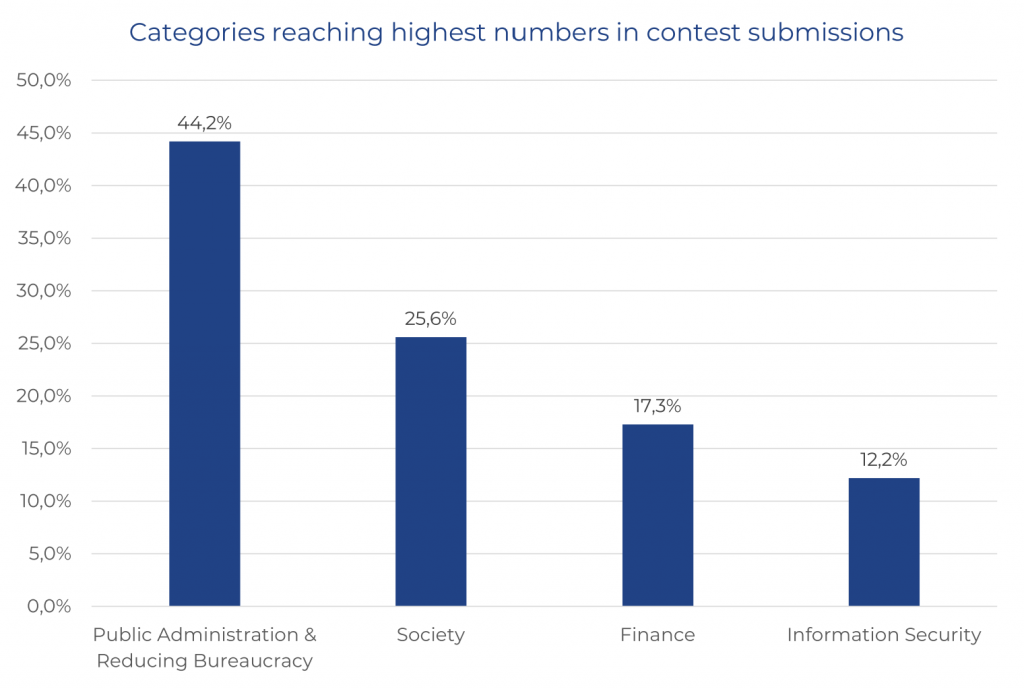

The large number of contest submissions highlights the broad range of potential eID applications in all areas of daily life. Our contest participants recognized that the demand for digital identity solutions is greatest in public administration and for reducing bureaucracy. A case in point is EASY ID, a contest entry that simplifies the processing and sharing of a user’s address, bank details or ID card. Another entry, entitled “e-ID proves your knowledge”, focuses on the submission of education certificates. The contest entries cover many areas of daily life, with public administration and reducing bureaucracy accounting for the largest share (44 %), followed by society (26 %), finance (17 %) and information security (12 %).

Source OeNPAY: Most of the ideas came from these four categories. Multiple allocations possible.

Identity verification plays an important role in our day-to-day lives, as it allows us to prove who we are. This is what passports or identity cards are for. Now the identity verification process has gone digital thanks to modern technology: People can use digital ID solutions to access public and other services where they once had to show up in person – it’s simple, fast and secure.

Electronic identity (e-ID) solutions enable individuals and businesses to provide digital proof of who they are. An e-ID issued by a certified provider serves as a legally valid, standardized electronic means of identification. It can be used to authorize transactions, to ensure the secure transfer of personal data and certificates, and to provide a legally binding digital signature.

Today, e-ID solutions are used in several fields. For instance, they are absolutely essential for electronic payments. Based on modern technologies and legally compliant, these e-ID solutions provide simple and secure access to digital financial services such as one-time payments, digital banking services or loan applications. e-ID solutions can be used for far more than that, though – they come in helpful in all digital interactions that require proof of identity.

A number of private and public sector organizations provide different types of e-ID solutions in Austria, but none of them is widely used for a broad range of applications. As a result, several national and international public and private sector e-ID solutions co-exist in the market. Many of them are neither interoperable nor do they meet uniform legal and security standards. Austria does not have a comprehensive cross-sector solution that individuals and businesses can rely on for different types of applications.

Easy to use: Once installed, the e-ID becomes a standard feature of people’s digital wallets and a constant companion – one single technology that offers numerous functions. For instance, the e-ID allows people to access government services online where they once had to go in person.

Interoperable: An interoperable e-ID infrastructure ensures that several e-ID solutions by different providers can co-exist in the market.

International: In line with the EU’s efforts to create a European digital identity, OeNPAY aims to help create a national e-ID infrastructure that is interoperable across borders, so that Austrian e-IDs are accepted in other EU countries and vice versa.

Secure: A comprehensive e-ID infrastructure conforms to GDPR standards and meets the requirements of the European eIDAS Regulation. It helps protect privacy, reduce crime and fraud, and protect against data misuse and identity theft.

Transparent and user-controlled: A comprehensive e-ID infrastructure allows users to control what happens to their data and which details they reveal about themselves.

Digitized: A national, interoperable e-ID infrastructure promotes digitization and adds to the country’s appeal as a business location.

The European Commission works on developing a legal framework (eIDAS 2.0) for a European digital identity. The digital wallet (EU Digital Identity Wallet) should serve as a means for people and companies to identify themselves for public and private services within the EU and to prove certain information.

During the circle17 impactathon, startups and university students joined forces with OeNPAY and the Oesterreichische Nationalbank (OeNB) to explore innovative approaches to cash logistics that are sustainable and have a regional focus.

Cash is still the most popular means of payment in Austria. In retail transactions, it is used less frequently than before, though. In light of declining cash transactions and the constantly shrinking bank branch network (and its cash services), both trading companies and financial institutions in Austria are faced with a key challenge: how to ensure the supply and distribution of cash throughout the country in the long run.

OeNPAY and the OeNB launched a joint initiative on cash innovation at circle17, a program launched by two nonprofit organizations, AustrianStartups and respACT, in an effort to help implement the UN Sustainable Development Goals. The participants of the circle17 impactathon were asked to develop innovative solutions for the following task: How can we ensure access to cash in rural regions and promote a regional cash cycle?

A new approach to cash logistics is required to accommodate changes in payment habits and banking infrastructure. Regional and sustainable solutions are the highest priority.

“Supplying Austrians with euro cash is one of the OeNB’s core tasks,” says Matthias Schroth, Director of the OeNB’s Cash Management, Equity Interests and Internal Services Department. “With the circle17 impactathon, we are challenging around 130 participating startups and university students to come up with future-proof, seamless and sustainable cash logistics solutions.”

circle17 impactathon innovator Manuel Hartl convinced the jury with his idea of integrating cash logistics into existing regional infrastructures: By providing secure cash withdrawal services, local businesses (such as small grocers, diners or tobacconists) would support the seamless supply of cash to consumers across the country. Hartl proposes a simple-to-use and secure app for this purpose.

In addition to ensuring cash supply at the regional level, the idea would also benefit local businesses: “Cash services are certain to attract customers to the store,” says OeNPAY Managing Director Bernhard Krick, “and businesses that offer them can reduce their cash holdings in a simple and secure manner and save money on cash collection services.”

e-IDentify yourself! – OeNPAY Electronic Identity Challenge: Submit your ideas by 31 August 2022.

A number of private and public sector organizations provide different types of e-ID solutions in Austria, but none of them is widely used for a broad range of applications. As a result, several national and international public and private sector e-ID solutions co-exist in the market. Many of them are neither interoperable nor do they meet uniform legal and security standards. Austria does not have a comprehensive cross-sector solution that individuals and businesses can rely on for different types of applications. By launching the challenge „e-IDentify yourself!“, OeNPAY aims to help shape the future of e-ID applications in Austria.

e-IDs offer numerous benefits for individuals, businesses and public institutions. Taking full advantage of them requires a national e-ID infrastructure that meets cross-industry interoperability standards. The goal is an e-ID solution that serves as an interface to both private sector services and e-government services. OeNPAY aims to lay the foundation for such a comprehensive e-ID infrastructure in Austria in cooperation with all stakeholders.

This is why OeNPAY has organized the “e-IDentify yourself! – OeNPAY Electronic Identity Challenge”: to crowdsource ideas for brilliant, new e-ID applications that transcend the range of existing solutions and can be used in all walks of life. The most promising ideas will be analyzed and developed further – and possibly even implemented with partner organizations. The OeNPAY idea contest aims to contribute to developing a comprehensive, interoperable e-ID infrastructure and to enhancing Austria’s appeal as a business location in cooperation with all stakeholders.

Consumers expect convenience, easy and fast handling, security, no costs, consumer protection and added value. The success of digital ecosystems and payment embedded in marketplaces show the advantage of convenient payments without media discontinuity.

Merchants expect low costs, free choice of service providers and transaction bundling. Low costs and a wide choice of service providers as well as strong branding increase acceptance in retail. New payment models become possible due to the change in acquiring.

Issuers expect reuse of existing SCT infrastructures and high end-customer relevance. SCT Inst is the logical further development of existing SCT infrastructures and enables the reuse of investments made with little additional effort. Issuers can reduce their processing costs by up to a factor of 14 compared to ICS debit (International Card Schemes).

Instant Payments (IP) have the potential to replace card, cash and other payment methods. In Austria and Germany, more than 40% of merchant sales can be substituted by IP in the future, with a focus on debit card potential.

Request-to-pay can enable easy communication between customer wallet and merchant. User-friendly solutions to request and initiate a payment at the point of sale (POS) create applications with high convenience and speed.

Issuer-merchant partnerships offer added value to customers and create use cases with higher customer loyalty, acceptance of IP as a payment instrument and potential additional revenues. Issuer and merchant. These can generate new business and remuneration models through bilateral and multilateral agreements.

Silos break down, flat and simple structures emerge. Account-to-account payment methods create alternatives to established card processes and traditional payment silos. Superfluous layers and service modules are eliminated, entrenched structures are opened up and more competition and innovation emerge.

Examples of applied IP in Europe are already being planned and implemented. With the EMPSA members (European Mobile Payment Systems Association) as a “bottom-up” example of applied IP and the EPI (European Payments Initiative) as a pan-European approach, there are already examples of innovative payment solutions based on existing account infrastructure.

The combination of open banking and IP generates new use cases and creates investment security for players. Uniform rules and fair distribution of revenues create investment security and an equal playing field for issuers, merchants and FinTechs.

Study partners: