oenpay and AIT published their joint study “Digitalization in payments and effects on vulnerable groups”. The study examines the influence of digital technologies in payments and identifies vulnerable groups for whom digital payment technologies represent potential challenges and barriers, according to the oenpay management about the motivation for the study:

In the study, vulnerabilities are defined as being based on various social and contextual factors, say AIT project leaders Georg Regal and Julia Himmelsbach on the challenges of digitalization in payments:

The study was carried out using literature and secondary data analysis in the first step, and a questionnaire study (online and as a paper & pencil survey) in the second step. The frequency of use, usefulness, availability and accessibility of payment technologies were examined with regard to five vulnerable groups:

The present study shows that digital payment transactions have a number of barriers, especially for vulnerable groups.

The barriers mentioned include both technical (e.g. complexity of the systems, lack of accessibility) as well as social (e.g. lack of support) and individual aspects (e.g. reactance and negative attitudes, lack of previous experience).

Digital skills and trust in banks are key individual levers for promoting inclusion in digital payments. The results suggest that measures are needed to promote technical accessibility, availability, support, digital competence and trust in banks.

With regard to the respective vulnerable groups examined, it can be seen that people with disabilities, older people and people from low social classes are considered vulnerable groups in digital payments:

The complete study can be downloaded free of charge from the oenpay community platform oenpay – Payments Innovation HUB. You can register here for free:

Financial technology continues to develop at a rapid pace and is subject to constant change. The FinTech-Landscape Austria by oenpay offers a comprehensive overview of the FinTech ecosystem in Austria in 2025. In doing so, we aim to facilitate partnership opportunities between start-ups, companies and research institutions and to promote innovation in Austria.

Our infographic highlights players and gives insights into the Austrian FinTech sector: The FinTech-Landscape Austria lists over 150 FinTech companies located in Austria, divided into 9 different categories. This reflects the range of innovative products and services from the financial sector:

Alongside the above categories for startups and companies, the ‘Enabler Ecosystem’ category is considered to include companies and organisations which support and promote the FinTech ecosystem in Austria.

The FinTech Landscape Austria differentiates between startups and established companies. Based on the AWS startup definition, we have used the novelty of technology or business model and the founding period (i.e. no longer than 5 years) as criteria to distinguish startups. Out of 155 FinTechs in total, 38 can be classified as startup.This showcases the diversity and dynamics of the FinTech sector in Austria.

Around 80% of these FinTech companies are based in Vienna, making the Austrian capital the centre for FinTech innovation in Austria.

In the FinTech-Landscape Austria, you will find 23 licensed payment institutions regulated by the Financial Market Authority. These include licensed payment institutions from Austria as well as EEA payment institutions with the right of establishment in Austria.

In the category ‘Crypto and Blockchain‘, service providers related to virtual currency in Austria, licensed e-money institutions from Austria, and EEA e-money institutions with the right of establishment in Austria are also considered.

Detailed information can be found here: FMA-Database

The FinTech-Landscape Austria lists banking groups which represent all banks in Austria. The established Austrian financial institutions often have a long history and tradition in the financial sector. In recent years, many banks have started working with FinTech companies and founding startups themselves.

The initiative “Sicher Bezahlen” was initiated by the OeNB and is intended to serve as a central contact point for greater security in digital payment transactions. Together with banks, interest groups and public institutions, we are bundling resources and information offerings as part of the “Sicher Bezahlen” initiative in order to make a lasting contribution to the security of citizens when paying online and offline.

“Sicher Bezahlen” aims to combat the rapidly increasing dangers for citizens when paying, particularly through prevention, information and education.

As part of the initiative, oenpay created the information platform www.sicher-bezahlen.at in collaboration with the OeNB and partners. As a one-stop shop, the website brings together cross-industry information and resources for secure payments and thus offers citizens important information from a single source.

The website provides tips and instructions for the safe use of various means of payment. In addition, current scams and contact points in the event of an actual fraud case are listed and an overview of current initiatives and events on the subject of secure payment is offered.

The information platform “Sicher Bezahlen” was published and presented at a press conference on December 6, 2024.

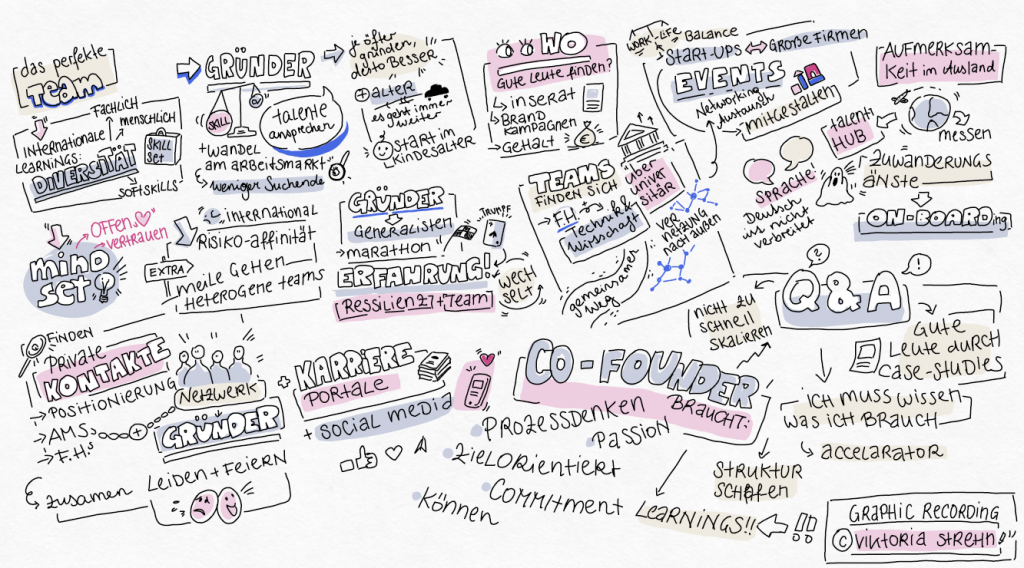

Graphic recording picture by ⓒ Viktoria Strehn

FinTech Rocks! is the new event series organized by oenpay together with the FinTech community. With the events, we pursue the goal of specifically strengthening the FinTech ecosystem in Austria and contributing to networking and collaboration. FinTech Rocks! offers FinTechs in Austria a stage to present their success stories. The events also critically discuss which obstacles need to be removed in order to promote innovation in Austria.

The event series is primarily aimed at founders and startups which are active in Austria, as well as banks, investors, research institutions, payment service providers and everyone who is interested in the topic of FinTech.

On October 10, the second FinTech Rocks! event took place at the location ‘Das Packhaus’. Together with a top-class panel, we discussed this time the topic of “Critical success factors for startups and FinTechs – How do I find the best team?”

The panelists came from different fields and shared their knowledge on this topic with us. And what did we take away from this panel discussion?

“It is important to know which skills, seniority levels and diversity dimensions you need in the team and which talents you want to attract accordingly. Then you can optimally put together the package that you offer as an employer and communicate it authentically.” – Claudia Eder (karriere.at)

“Courage, going the extra mile, as well as a high level of innovation play a particularly important role for startups and FinTechs. It is precisely these factors that are often found in international talents who make an important contribution to the Austrian economy with their willingness to take risks and their specific skills. Since it is usually not so easy to gain access to the best minds internationally, WORK in AUSTRIA offers Austrian companies free services from a single source.” – Margit Kreuzhuber (ABA – WORK in AUSTRIA)

“If you don’t know what you need yourself, you can’t expect others to bring the solution.” – (David Schnetzer, Gubbi AG)

“Good teams are created through human and professional diversity, and universities of applied sciences or universities are a great tool for this.” – Rafael Rasinger (University of Applied Sciences Technikum Wien)

“Age also plays a big issue. The FinTech industry is a very special industry, many startups or FinTechs are founded by very young people in their mid-20s and you have to prove to yourself again and again that you are doing something because of your age. Age is often a blockage.” – Alexander Valtingojer (FinTech Austria)

“An interdisciplinary team is the most valuable asset for startups, especially in times like these. The diversity of perspectives opens up new paths for creative solutions and drives innovation.” – Conny Wriesnig (Der Brutkasten)

ⓒ oenpay

With do-gether, Thomas Nayer has created a network that easily connects those seeking help and those helping. He wants to offer a quick help in the digital age to promote social cohesion, because as Thomas says: “Things are simply better together!”

I do believe that many people of my generation feel an inner drive to change the world positively. Since I was able to be part of a number of programs last year that aim to introduce young people to entrepreneurship, I know that there is a desire for change, especially in areas such as the environment, equality and education. Unfortunately, there are far fewer people who actually implement the idea, be it because of a lack of money, know-how or time.

Over the last year, I’ve been able to learn and experience a lot of new things while developing my idea. It started with the founding of my GmbH, the development of a business plan together with oenpay, appointments with my partners from Ahoi Kapptn! for programming my app and this continues to this day. In the last few months I have also been working on a marketing strategy. This was and is really learning by doing, a very interesting and exciting process.

I had the idea because I realized that I wasn’t equal to other people and that other people could easily help with many things, but I didn’t have the network. I also noticed that many people often need a little quick help, but there is no network for that. Nowadays, we need to come closer together again and help each other.

Actually, you can’t talk about difficult aspects, because of course there were always ups and downs, but they exist everywhere. The important thing is to stick with it, keep your nerve when faced with difficulties and look for solutions. You should be aware that everything will probably not always be perfect at the beginning and that you may have to make improvements later, but that is no reason to lose your nerves and give up everything. Stay tuned and carry on is my motto!

do-gether, founded by Thomas Nayer, 21 years old and wheelchair user, wants to bring the term help into the digital age and be a platform for all kinds of assistance. With a user-friendly app, a simple payment system and a focus on safety and above all community, do-gether strives to change the way people can help each other quickly and easily.

You can download the app here do-gether.at for free!

FinTech Rocks! is the new event series organized by oenpay together with the FinTech community. With the events, we pursue the goal of specifically strengthening the FinTech ecosystem in Austria and contributing to networking and collaboration. FinTech Rocks! offers FinTechs in Austria a stage to present their success stories. The events also critically discuss which obstacles need to be removed in order to promote innovation in Austria.

The event series is primarily aimed at founders and startups which are active in Austria, as well as banks, investors, research institutions, payment service providers and everyone who is interested in the topic of FinTech.

The very first kick-off event of the FinTech Rocks! series took place on June 26, 2024. It’s focus: the success factors most important for fintechs and startups in Austria.

In the scope of a panel discussion, moderator Paul Wessely, Senior Innovation Manager at oenpay, investigated the key factors for fintechs and startups together with the top-class panel – Philipp Bohrn from Bitpanda, Alexander Eisl from FINcredible, Kambis Kohansal Vajargah from the Austrian Federal Economic Chamber, Adrian Zettl from AustrianStartups, Johannes Sarx from Austria Wirtschaftsservice und Christian Wolf, Raiffeisen Bank International AG – and interested event participants.

The result:

FinTech Rocks! is planned as a long-term events initiative set out to take place quarterly in the future. The next event is expected to take place in September.

The study was developed in collaboration with payment transaction experts from banks and the market research institute marketmind and published by oenpay in March 2024.

In the EU, instant payments (German: Echtzeitüberweisungen) are transfers in euros based on the ‚SEPA Instant Credit Transfer Scheme‘ (SCT Inst) through which money is made available in the recipient’s account within ten seconds of the payment order being issued. What is special about SCT Inst is that it runs around the clock, 365 days a year.

To represent Austria, 1,165 people were questioned about their age, gender, education and federal state in computer-assisted web and telephone interviews. The surveys were carried out between December 15, 2023 and January 19, 2024.

In particular, the study provides valuable insights into the awareness and current usage of instant payments, their potential as well as motives for using them. We have summarised the most important findings for you below.

The study results will be made available in full for download on our community platform oenpay – Payments Innovation HUB:

You are not yet a member of our community platform? Simply register here for free in advance to download the study.

Advancing digitalization is fundamentally changing the way we pay. This poses major challenges for the economy and society.

Therefore, oenpay aims to promote the digitalization of payments in Austria and beyond. As a hub of a cross-industry innovation community, oenpay supports the development of innovative, sustainable, inclusive and secure payment solutions together with all stakeholders involved.

Under the motto “Together for innovation in payments”, oenpay launched the Austrian Payments Innovation Award for the first time this year under the patronage of the OeNB.

The prize was awarded by oenpay – Financial Innovation Hub (oenpay) under the patronage of the Austrian National Bank (OeNB) and with active support from Austrian banks, payment service providers and FinTechs. The award was established to recognize the best innovations in payments in Austria and to strengthen the domestic payments community.

Over a period of four weeks, 22 innovation projects were submitted for the award. An overview of all submissions is listed below:

| Unternehmen | Eingereichtes Projekt |

| Authentic Vision | Holographic Fingerprint Since 2021, the integration of the “Holographic Fingerprint” – a holographic, forgery-proof label – into debit cards in collaboration between UniCredit Bank Austria and Authentic Vision has been revolutionizing the protection of customer accounts. |

| BAWAG P.S.K. Bank für Arbeit und Wirtschaft und Österreichische Postsparkasse | BAWAG Business Banking EBICS Web and App BAWAG developed a web-based solution that can communicate not only with BAWAG-accounts, but also with all EBICS-enabled bank accounts in Europe. |

| Blocktrade | Blocktrade Blocktrade is the first fully EU-regulated and gamified crypto platform, bringing together digital assets, gaming, and commerce. |

| Bluecode | Payment Roaming in Europe The solution pursues the vision that users can pay with their usual mobile payment solution via the network of other European mobile payment providers. |

| Bluecode | Bluecode Instant Bluecode has developed Bluecode Instant – a system that combines the advantages of instant payments and classic P2M transactions. |

| Die Zweite Wiener Vereins-Sparcasse | ‚Account with gambling protection‘ for 2. Sparkasse With the initiative ‚Account with gambling protection‘, 2. Sparkasse is the only bank in Austria that has created the possibility of blocking gambling transactions (and only these). |

| Erste Bank | Smart- and Premiumcard The “Smart and Premium Card” project, implemented in September 2022, was about redesigning the entire credit card portfolio of Erste Bank und Sparkassen. |

| Erste Bank | VISA Premiumcard Privat Banking Together with the Erste Bank‘s private banking department, Erste Bank has replaced the previous private banking card with the VISA Private Banking Card and equipped it with new and exclusive features. |

| Erste Bank | Google Pay Erste Bank und Sparkassen was the first major Austrian bank to launch Google Pay in December 2022. |

| fiskaly | Digitale Beleglösung With it’s digital receipt solution, fiskaly offers modern software that meets the needs of today’s retail industry. |

| Iknaio Cryptoasset Analytics | Iknaio Cryptoasset Analytics Iknaio Cryptoasset Analytics GmbH is revolutionizing the fight against cybercrime and crypto fraud, while promoting financial inclusion by making cryptocurrencies safer to use. |

| IM Polymer | The first card to grow back! For environmentally conscious companies, the biocard made of bioplastic is the sustainable and environmentally friendly alternative to conventional products made of petroleum plastic or petroleum plastic-coated paper. |

| K42 Ventures | BANKpay+ BANKpay+ has launched a new version of its SEPAinstant+ SEPAid service, enabling real-time payments and bank status notifications across 5300+ European banks. |

| Linde Verlag und Georg Tuder | Handbook Payments 4.0 The 23-person team of authors from the areas of practice, law, science and supervisory authorities takes a closer legal look at the topics mentioned in the ‚Handbook Payments 4.0‘. |

| Oberbank | Order foreign currency online Oberbank offers customers the opportunity to order selected foreign currencies directly in the Oberbank customer portal and in the Oberbank app – in the future also with shipping directly to customers. |

| Paysafe | Paysafe: Alternative to the bank account Account & Card is like a conventional account where customers receive a personal IBAN, a physical and a virtual Debit Mastercard. |

| P19 | P19 Payment Podcast With the P19 Payment Podcast, P19 wants to bring payment closer to everyone – experts, laypeople and everyone in between – and shed light on all its facets. |

| Raiffeisen Bank International | Virtual IBAN (VBAN) Virtual IBAN – a simple time and cost‐saving solution – can change the way our corporate customers or non-bank FIs do accounting by helping automate this process. |

| Raiffeisen Bank International | Virtual Accounts Virtual Accounts fulfil the corporates’ desire to centralize their cash and liquidity management while always keeping a transparent overview on payment flows as well as simplifying bank account structures. |

| Raiffeisenbankengruppe Österreich & Raiffeisen Bank International | RaiPay The RaiPay payment wallet offers customers access to a state-of-the-art payment solution for digital debit and credit cards; P2P payments, card management and much more, independent of other X-Pays such as Google Pay and Apple Pay but also of providers of payable wearables (Garmin, Swatch, …). |

| Raiffeisenlandesbank Niederösterreich-Wien | Investments in digital assets from one euro and without delay By integrating Bitpanda Technology Solutions’s investment infrastructure into the mobile banking app ‚Mein ELBA‘,RLB NÖ-Wien gives its customers easy, fast and secure access to more than 2,500 digital assets (including cryptocurrencies and precious metals) starting at just one euro. |

| SocialCard | SocialCard SocialCard is a cashless and direct donation option to homeless and poverty-stricken people, including those whose situation excludes them from cashless payments. |

Innovation pays off! Three winning teams were awarded at the Austrian Payments Innovation Gala, which took place for the first time on April 4, 2024. The governor of the Austrian Central Bank, Univ.-Prof. Dr. Robert Holzmann, kicked off the event. The winning teams of this year’s Austrian Payments Innovation Awards received exciting prizes.

The high-tier expert jury, made up of nine payments, startup and innovation experts, evaluated the submitted projects based on oenpay’s four core values.

Raiffeisenlandesbank Niederösterreich-Wien (RLB NÖ-Wien) was awarded the first prize with their solution for investments in digital assets from one euro and without waiting times, which was implemented in cooperation with Bitpanda. By integrating Bitpanda Technology Solutions’ investment infrastructure into the mobile banking app ‚My ELBA‘, the winning solution provides customers with an easy, fast and secure access to over 2,500 digital assets (stocks & ETFs, raw materials, precious metals and Cryptos) from just one euro. Payments are processed very conveniently directly via the customer’s checking account.

As the main prize, the first place winners won a four-day learning trip to Silicon Savannah in Nairobi. The Learning Journey offers the winners exciting insights into the startup ecosystem and digital transformation in East Africa. In addition to discussions, field visits and networking, participants can explore the regional payment ecosystem – from M-Pesa Mobile Money, to banks and FinTechs.

SocialCard was able to secure the second place with its solution for a cashless and direct donation option to homeless and poverty-stricken people (including those who are excluded from cashless payment transactions due to their situation). Using a QR code, people can receive donations without an account or digital device. Donations can be made via credit card and soon also via the monetary value of unused loyalty points from various loyalty programs for customers. The person can then redeem these donations with partners for services and everyday products. In a pilot project, SocialCard has already been successfully implemented as a cashless payment option for the street newspaper “Apropos” in Salzburg.

The third place went to Bluecode for their innovation project Payment Roaming in Europe, which enables seamless payments across national borders. Bluecode has founded the European Mobile Payment Systems Association (EMPSA) together with other European mobile payment solutions. The solution pursues the vision that users can pay with their usual mobile payment solution via the network of other European mobile payment providers. The principle of roaming, which is already known from telecommunications, hence, is also used in payments. In an already successful pilot test, it was shown how the mobile payment solutions Bluecode (Austria and Germany), TWINT (Switzerland) and Bancomat Pay (Italy) pay at each other’s acceptance points.

The second and third placed teams were also awarded smaller prizes.

You can find further impressions of the Austrian Payments Innovation Gala here:

The winners of the oenpay – Virtual Design Challenge were announced! The entrepreneurs Michael Baumgartner, Daniel Gosterxeier and Nikolaus Stickler were able to secure the first place with their creative design concept. As part of the winners’ presentation on 13th October, oenpay awarded them the first prize including 2,000 euros in prize money.

The winning idea convinced oenpay with its innovative design concept in the form of a coin with surrounding themes and an event pavilion inspired by the oenpay logo. ‚We particularly liked the modular structure and the graphic design of the creative design matching the oenpay branding,‘ says oenpay Senior Innovation Manager and Project Manager Mirjana Covic, ‘The elaborated design concept offers us many opportunities to test and develop new applications in virtual reality for payment transactions together with our partners.‘

In a joint interview, the winners Michael Baumgartner, Daniel Gosterxeier and Nikolaus Stickler give an insight into their professional careers and their thoughts on the Virtual Design Challenge.

NiftyTwins is Austria’s first premium NFT agency. In addition to creative concepts for a virtual presence, we also offer companies workshops and the practical implementation of virtual business models and locations. From real estate to law firms, all implementations can be developed and implemented IN-HOUSE.

At NiftyTwins, we are always looking for new challenges. The concept of oenpay particularly appealed to us because it rethinks traditional payment transactions and pursues innovative approaches. We are very proud of our successful concept and winning the first prize.

We are fascinated by the metaverse and virtual reality for a variety of reasons. We are convinced that once the technical hurdles of the metaverse are overcome, a real revolution in the field of virtual worlds and business models is imminent. Some companies have already started investing in this future, and international clients are working with us to figure out how their brands can gain a foothold in the virtual age.

During the creative implementation for oenpay, our focus was on creating an open and inviting space. A space that creates trust and takes people on an exciting journey through the topic of payment transactions. All on-site information should also be reduced as much as possible and brought to the point quickly. The goal is to discover and have fun with new technologies.

The biggest challenge in designing this space was to present the complex topic of ‚payment transactions‘ in an understandable and engaging way. At the same time, we had to ensure that the ‘oenpay‘ brand was adequately represented in this virtual space and that the technical limitations of the various metaverse platforms were observed. However, due to our many years of experience and technical expertise, we have been able to meet these challenges.

As part of the Virtual Design Challenge, oenpay is pursuing the goal of tapping into the potential of virtual reality (VR) for itself and partner companies and making new applications a virtual experience. The innovation initiative is particularly interested in researching new payment solutions that can be used to process digital transactions in virtual space securely and easily. The virtual space is intended to support this mission through a modular structure and versatile functions. The design had to be futuristic, in line with oenpay’s brand identity and take up the topic of “payment transactions” in an innovative way.

In October 2021, the team „Exdome“ presented their idea of a personalized, 3D-printed card case in the scope of the initiative „Youth Entrepreneurship Week“. Since then the aspiring young entrepreneurs – Stefan Brodar, Lukas Poppinger, Lukas Harrer and David Draschkowits – have been supported by oenpay and have been working together with the innovation initiative on the development of a ‘digital hardware wallet’.

A digital wallet allows its owners to complete payment transactions, for instance by debit or credit card in store or online in a web shop. While digital wallets are mostly made available as a ‘mobile app’ on the smartphone (mobile wallet), they can also come in the form of a software program on the PC or in the web browser.

Digital wallets can usually be used in many ways and, in addition to the payment function, can also store customer cards, tickets (boarding passes, concert tickets) or vouchers, for example.

A hardware wallet is a special form of digital wallet; it is a physical device and you do not need a smartphone to use it.

oenpay wants to proactively shape the payment solutions of tomorrow. In its mission, oenpay encourages collaboration not only with with banks, companies and fintechs, but also focusses on supporting young talents and their ideas.

oenpay has been involved in the ‘Youth Entrepreneurship Week’ initiative in various roles since autumn 2021. The ‘Youth Entrepreneurship Week’ supports young people in the development of new ideas and projects and is a joint initiative presented the Federal Ministry of Labor and Economy, the Federal Ministry of Education, Science and Research, the Austrian Economic Chamber, Austrian Startups and IFTE – Entrepreneurship4Youth. Over 3 ½ days, young talents are invited to dip into the world of entrepreneurship and to work on solutions of the future.

They get the tools they need from trainers and people from the startup community. In addition, they are supported by their dedicated teachers. The associations Austrian Startups and IFTE play a key role in the organization and implementation of the “Youth Entrepreneurship Week”.

Find more information on the current ‘Youth Entrepreneurship Week’ here.

Christoph Cordt, Project Manager at oenpay for digital hardware wallet project, discussed in an interview with the Exdome team and oenpay Managing Director Bernhard Krick how the project evolved and how successful it may be in the future according to oenpay.

Bernhard Krick: ‘At a ‘Demo Day’ of the Youth Entrepreneurship Week at HTL Hollabrunn, during which the students presented their ideas, the team called ‘Exdome’ caught my attention. They presented a 3D-printed, customizable card case to safely store payment cards and loyalty cards. They performed very confidently and had even developed a prototype. The whole team made a very good impression on me. On that day, their idea scored the good second place.’

Bernhard Krick: ‘While I wasn’t immediately interested in the card case idea, it gave me the idea of designing a ‘hardware wallet’ combining the functions of a digital wallet and a payment card. This wallet should enable people who have difficulties using a smartphone to complete digital payment transactions safely and easily. So I approached the students and asked them if they were interested in working out this modified idea together with oenpay and shared my contact details with them.’

Stefan Brodar: ‘A week later, we emailed Bernhard to set up a meeting. oenpay then offered us an internship during which we could work out the concept of the digital hardware wallet. We liked the idea and considered the intership an amazing opportunity to gain experience; so we accepted and successfully completed our internship in the summer of 2022. Moreover, after our internship, we were given the opportunity to take part in a hackathon at the National Bank in autumn 2022.’

Lukas Harrer: ‘Stefan, Lukas and David approached me and told me abouth the hackathon. The challenge asked to develop a concept for the transaction of ‘digital change’ to be used to make donations. They asked me if I would like to participate and support them with software development. I joined them immediately. We were able to score second place with our solution. Participating in the hackathon was exciting and we had a lot of fun.’

David Draschkowits: ‘In return, we won a full-day personal tour through the Oesterreichische Nationalbank conducted by different departments and their employees during which we gained insights into the organization and processes. In addition, we were given the chance by oenpay to continue working on our ‘digital hardware wallet’ project.’

Lukas Poppinger: ‘Since April 2023, we are employed by oenpay as freelancers which allows us to independently develop further our project and to seek support from oenpay staff when needed. With the help of oenpay, we aim to implement and launch our concept and prototype on the market some day. This keeps us motivated to constantly improve our idea.’

Bernhard Krick: ‘I am still very excited to see the commitment of these aspiring young entrepreneurs. The team has already come a long way together, they have acquired knowledge and worked out a solid concept. The cooperation in the team and with oenpay has worked out great without any problems. The involvement of the potential target group will be particularly important when developing a prototype of the hardware wallet. I also do believe that there is a need for such a product. Digitization is progressing at a great pace. Above all, this also influences the way in which we will pay for goods and services in the future. It is particularly important to oenpay that everyone has access to digital payment transactions and that nobody is left behind in the digital transformation. It will take some time to finishe the product concept. But if they continue to work well together as a team in the future, then they will be successful. Of course, oenpay will continue to support them to see them grow.’